Oracole Investing Strategy - Applying The Charts

This blog tracks the development of market indicators and their use for long term market forecasting; mostly suitable for long term investments instruments such as mutual funds (see individual stock strategy below). The goal of these indicators is to indicate periods for entry and exit into the market. Currently Oracole.com tracks the S&P 500 market sentiment and provides updated charts on a weekly basis along with an interpretation of the signals. The interpretation of the signals is summarized on the price line as one of four color coded options as described below:

- Buy - a buy signal (green) which indicates a long term signal has confirmed its trend.

- Tentative Buy - a buy signal (yellow) that indicates a good opportunity, but the signal has indicated before a long term trend is established which means there is greater risk of reversal but potentially higher returns.

- Sell - a sell signal (red) which indicates a long term signal has confirmed a trend shift.

- Tentative Sell - a sell signal (purple) that indicates a good opportunity, but the signal has indicated before a long term trend is established which means there is greater risk of reversal but potentially higher returns.

|

| Click On Example Chart To Enlarge (See Posts or Chart Page For Most Recent) |

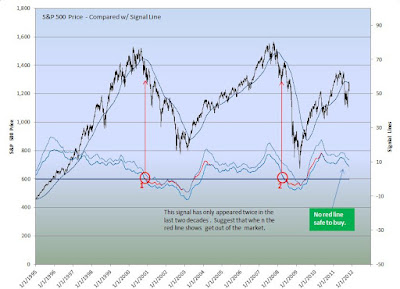

The methodology employed to develop the market sentiment chart is based on a customized moving average convergence divergence (MACD) adjusted to provide signals on a 200 day (long) and 50 day (intermediate) moving average basis. The color coded signals transfered to the price line also contain what I call the "Super Signal". The "Super Signal" is developed based on a rather complicated analysis of market volatility and has only indicated twice in the last two decades as the chart below shows (see the S&P 500 Super Signal Historical Charts Page for more information).

|

| Click On Example Chart To Enlarge (See Posts or Chart Page For Most Recent) |

These tools are not designed to pin point the high or low of the market, but to provide investors with indication of low risk market entry and exit periods. Therefore, it is imperative to employ a cost averaging strategy when executing entries or exits from or into any position. A good way to use this information would be to invest in an index fund that targets the returns of the S&P 500, Dow Jones Industrial Average, or similar. Below are some principals to follow when utilizing the information provided by the sentiment chart:

Principal 1.

Always execute a buy or sell order as close to the end of a trading day as possible (4:00 PM Eastern Time). This way you have a greater probability of anticipating the condition of the market at close.

Principal 2.

During "Tentative Buy" and "Buy" periods plan to make buy orders over about one full quarter and split the purchases out over daily or weekly periods. The same applies to "Tentative Sell" and "Sell" Periods.

Principal 3.

Pay attention to significant market moves. Significance can vary depending on market volatility. Typically a good rule of thumb for gauging significance would be any gain or loss that is greater than 2%. Or a method that I employ is to calculate the 200 day standard deviation of the market range (high - low) and multiply by 2 and subtract or add to the previous close price (I provide a weekly range in my blogs). This establishes an expected trading range that may indicate a good day to add to or exit from a position.

During "Tentative Buy" and "Buy" periods plan to make buy orders over about one full quarter and split the purchases out over daily or weekly periods. The same applies to "Tentative Sell" and "Sell" Periods.

Principal 3.

Pay attention to significant market moves. Significance can vary depending on market volatility. Typically a good rule of thumb for gauging significance would be any gain or loss that is greater than 2%. Or a method that I employ is to calculate the 200 day standard deviation of the market range (high - low) and multiply by 2 and subtract or add to the previous close price (I provide a weekly range in my blogs). This establishes an expected trading range that may indicate a good day to add to or exit from a position.

Example:

Last Close Price - 1122.36

2 X 200 day standard deviation of market range - 10.57 x 2 = +/- 21.14

Significant Close Low - 1101.22 (interested in this close price during buy periods)

Significant Close High - 1143.50 (interested in this close price during sell periods)

Principal 4.

Track the day since your last purchase order. CAUTION! Most mutual funds do not allow high frequency trading. Therefore, most will penalize you if a purchase order is followed by a sell order in less than 30 days; for some it could be the same quarter (see Mutual Fund Basics).

Principal 5.

"A bird in hand is worth two in the bush."

Set a target return (i.e. 5%, 7%, 10%, or more). Don't be greedy. When your mutual fund has returned that target return begin intermittently transferring funds out of the investment. Do Not forget Principal 4.

Principal 6.

Be patient ... probably the hardest thing to do, but wait for the signals and implement the plan. The difference between investing and speculating is a plan.

Note:

Historically those that have remained invested in the market (through thick and thin) have profited long term. Timing the market is very difficult. This strategy should only be employed with an understanding that all indicators have their weaknesses and that they are trying to forecast the future based on historical performance. Some indicators may be better than others, but none are fool proof.

Individual Stock Strategy

The market sentiment indicator can also be applied to long term investing in individual stocks, but one has to first determine if a stock moves with or against the broader market. All the principals listed above apply; except Principal 4 (although high frequency trading will cost you more).

The impact of trading fees is often overlooked, and can have a significant impact on a portfolio. If one considers as an example that you have $1,000 dollars to invest and there is a $5 transaction fee every time one buys or sells the stock. Therefore, the stock would have to appreciate at least 1% to see a profit. If all you had to invest is $1000 and you wanted to diversify into 4 different stocks, or $250 per stock, now you would need each investment to grow 4% to see a profit. You would likely be better off putting your $1000 into an index fund for long term management.

Track the day since your last purchase order. CAUTION! Most mutual funds do not allow high frequency trading. Therefore, most will penalize you if a purchase order is followed by a sell order in less than 30 days; for some it could be the same quarter (see Mutual Fund Basics).

Principal 5.

"A bird in hand is worth two in the bush."

Set a target return (i.e. 5%, 7%, 10%, or more). Don't be greedy. When your mutual fund has returned that target return begin intermittently transferring funds out of the investment. Do Not forget Principal 4.

Principal 6.

Be patient ... probably the hardest thing to do, but wait for the signals and implement the plan. The difference between investing and speculating is a plan.

Note:

Historically those that have remained invested in the market (through thick and thin) have profited long term. Timing the market is very difficult. This strategy should only be employed with an understanding that all indicators have their weaknesses and that they are trying to forecast the future based on historical performance. Some indicators may be better than others, but none are fool proof.

Individual Stock Strategy

The market sentiment indicator can also be applied to long term investing in individual stocks, but one has to first determine if a stock moves with or against the broader market. All the principals listed above apply; except Principal 4 (although high frequency trading will cost you more).

The impact of trading fees is often overlooked, and can have a significant impact on a portfolio. If one considers as an example that you have $1,000 dollars to invest and there is a $5 transaction fee every time one buys or sells the stock. Therefore, the stock would have to appreciate at least 1% to see a profit. If all you had to invest is $1000 and you wanted to diversify into 4 different stocks, or $250 per stock, now you would need each investment to grow 4% to see a profit. You would likely be better off putting your $1000 into an index fund for long term management.

No comments:

Post a Comment